Types of Individual Retirement Account

Retirement will likely be the greatest amount of your lifetime, which indicates saving for retirement is a big job. This is particularly true if you envision a retirement that is loaded with experiences such as traveling through Europe, using time with your grown children and grandkids, or turning your house into the Wild Kingdom of saving animals or whatever you like!

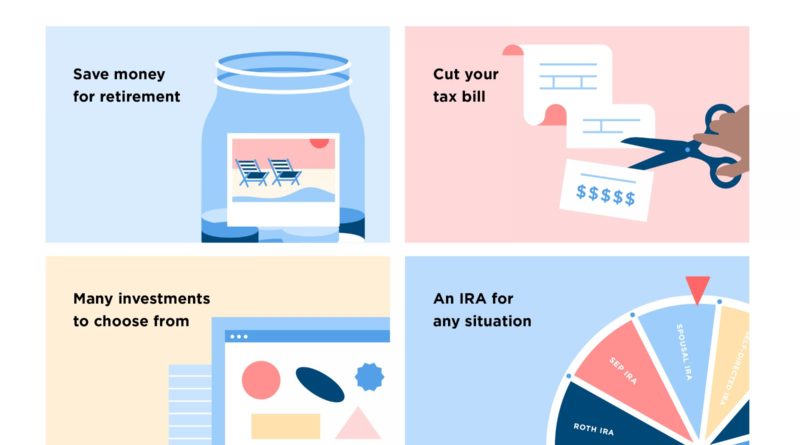

Why Use a Retirement Account over Just Saving

First, it’s essential to know that retirement accounts usually have tax advantages as opposed to saving within a “regular” savings account or investing with a brokerage account. There can be additional advantages to practicing a retirement account—such as an employer match in a 401(k)—but honestly, it’s the tax advantages that make them different.

Most retirement schemes are tax-deferred or otherwise tax-advantaged. Here I will discuss different types of IRA account so that you can compare top IRA accounts and understand what plan you should consider getting the best one.

What types of IRAs are there?

Traditional − You may be capable to deduct current participation to an IRA.

Roth − You give taxes now and will be qualified for tax-free withdrawals if the withdraw is done at five years or more after the January 1 of the first year that a Roth participation was made to the IRA and the withdrawal was on account of death, injury or attainment of age 59 ½.

Rollover − This IRA is intended for job changers, fresh retirees, or those desiring to consolidate retirement plans from former employers.

Several types of IRAs

- Traditional IRA – contributions are usually tax-deductible (usually clarified as “money is saved before tax” or “participation are made with pre-tax assets”), all transactions and profits within the IRA have no tax repercussions, and withdrawals at retirement are taxed as income (except for those parts of the withdrawal corresponding to benefactions that were not subtracted). Depending upon the characteristics of the contribution, a popular IRA may be a “deductible IRA” or a “non-deductible IRA”. Regular IRAs were introduced with the Employee Retirement Income Security Act of 1974 (ERISA) and gained popularity with the Economic Recovery Tax Act of 1981.

- Roth IRA – contributions are made with after-tax assets, all actions within the IRA have no tax consequence, and withdrawals of contributed funds are tax-free. Named after Senator William V. Roth, Jr., the Roth IRA was presented as a section of the Taxpayer Relief Act of 1997.

- myRA – a 2014 Obama administration action relying on the Roth IRA

- SEP IRA – a plan that lets an employer (generally a small business or self-employed person) execute retirement plan contributions into a Traditional IRA authorized in the employee’s name, rather than to a pension fund after the company’s name.

- SIMPLE IRA – a Savings Incentive Match Plan for Employees that need organization matching contributions to the layout whenever an employee does a contribution. The plan is similar to a 401(k) plan, but with more fair contribution limits and easier (and therefore less expensive) administration. Although it is named an IRA, it is operated independently.

- Rollover IRA – no real variation in tax treatment from a conventional IRA, yet the funds come from an adequate plan or 403(b) account and are “rolled over” into the rollover IRA rather than presented as cash. No other assets are mixed with these rollover amounts.

- Conduit IRA – Medium to transfer fitted investments from one account to another account. In order to maintain some special tax treatments, funds may not be mixed with other kinds of assets, comprising other IRAs.

Hope you have got the idea on the individual retirement account. Now you just need to get in touch with the desired one.